Noida has emerged as one of India’s hottest commercial real estate destinations, thanks to its strategic location, booming infrastructure, and business-friendly environment. Once known mainly as an industrial suburb, Noida is now a dynamic urban center attracting global companies, startups, retailers, and investors alike.

With rapid metro expansion, expressways, and upcoming mega-projects like Jewar International Airport and the Noida Film City, the city is transforming into a high-demand business hub. Its proximity to Delhi, competitive property pricing, and excellent connectivity to Gurgaon and Ghaziabad make it a preferred choice for commercial real estate buyers.

Whether you’re looking to invest in retail outlets, office spaces, co-working hubs, or hospitality units, Noida offers a range of high-growth sectors suited to various budgets and business needs. In this blog, we’ll explore the best sectors in Noida for commercial real estate investment, backed by data, price trends, and expert insights—so you can make an informed and profitable decision.

What Makes a Sector Ideal for Commercial Investment?

Choosing the right sector is crucial when it comes to commercial property investment, especially in a fast-developing city like Noida. Unlike residential real estate, commercial investments require a deeper understanding of foot traffic, demand generators, infrastructure, and long-term growth potential. Certain key elements define whether a sector is suitable for high-performing commercial property.

First, connectivity plays a pivotal role. Sectors that are well-connected via metro lines, expressways, and arterial roads naturally attract more footfall and visibility. Sectors like 18, 62, and 142 have benefitted immensely from their proximity to metro stations and major highways like the Noida-Greater Noida Expressway and DND Flyway.

Second, the presence of surrounding developments such as IT parks, office complexes, colleges, or densely populated residential zones ensures steady daily traffic. Commercial setups like cafes, shops, clinics, or coworking spaces thrive best when they’re located close to large office populations or residential catchments.

Third, infrastructure projects and master-planned amenities like parking spaces, walkable streets, and power backup make a commercial sector more tenant-friendly and reduce vacancy risks.

Finally, upcoming developments such as Jewar Airport, the Ganga Expressway, and the Noida Film City are influencing demand in previously overlooked areas, creating new commercial hotspots. These growth corridors signal future demand and appreciation, making them ideal for early investors.

Investors should also study zoning regulations, RERA registration, and builder track records to avoid future legal or operational complications.

Top Sectors in Noida for Commercial Property Investment

Noida is home to several sectors that have evolved into thriving commercial hubs, each catering to specific investment goals—from retail outlets and high-street shops to premium office spaces and coworking zones. Here’s a detailed look at the most promising sectors for commercial real estate investment, based on location, connectivity, existing demand, and future growth.

Sector 18 – The Heart of Noida’s Retail Scene

Sector 18 is synonymous with shopping and entertainment. Located near the DND Flyway and easily accessible via the Blue Line metro, this sector boasts some of Noida’s biggest malls, including The Great India Place and DLF Mall of India. Its high footfall makes it ideal for retail spaces, showrooms, restaurants, and service brands. Due to saturation and limited new supply, prices here are premium, but so is the visibility and return potential.

Sector 62 – A Growing IT and Office Space Corridor

Sector 62 has become the backbone of Noida’s IT and banking operations. It houses numerous software firms, educational institutions, and government offices. Investors eye this sector for Grade-A office buildings, coworking hubs, and commercial complexes that cater to working professionals. With close proximity to NH-24 and the Blue Line metro, it is highly accessible from both Noida and East Delhi.

Sectors 75 and 76 – Mid-Segment Commercial with Residential Leverage

Located along the Aqua Line metro and surrounded by densely populated residential sectors, Sectors 75 and 76 are becoming hotspots for high-street retail, salons, clinics, and small businesses. With many families and working professionals residing nearby, these sectors offer consistent rental demand and a relatively low entry cost for investors.

Sector 142 – Noida-Greater Noida Expressway Commercial Zone

Strategically placed along the Noida-Greater Noida Expressway, Sector 142 is known for its tech parks, especially the campus of Infosys and other IT/ITES companies. It’s a prime choice for those looking to invest in corporate office spaces or set up commercial buildings that attract institutional tenants. This sector is favored by investors targeting long-term rental income through corporate leasing.

Sector 104 – Rising Commercial District with Boutique Spaces

Sector 104 is steadily gaining traction due to its location near the Noida Expressway and proximity to high-end residential projects. It caters well to boutique offices, cafes, healthcare centers, and salons targeting an upscale clientele. With limited supply and growing demand, it presents early-mover advantages for investors.

Sector 150 – Lifestyle-Focused Commercial Opportunity

Known as Noida’s greenest and most premium sector, Sector 150 is drawing attention for its luxury residential projects and planned sports city. Commercial developments here focus on lifestyle spaces—cafes, fitness studios, fine dining, and specialty stores. It may not offer immediate returns but is a smart bet for long-term capital appreciation due to evolving demographics and infrastructure.

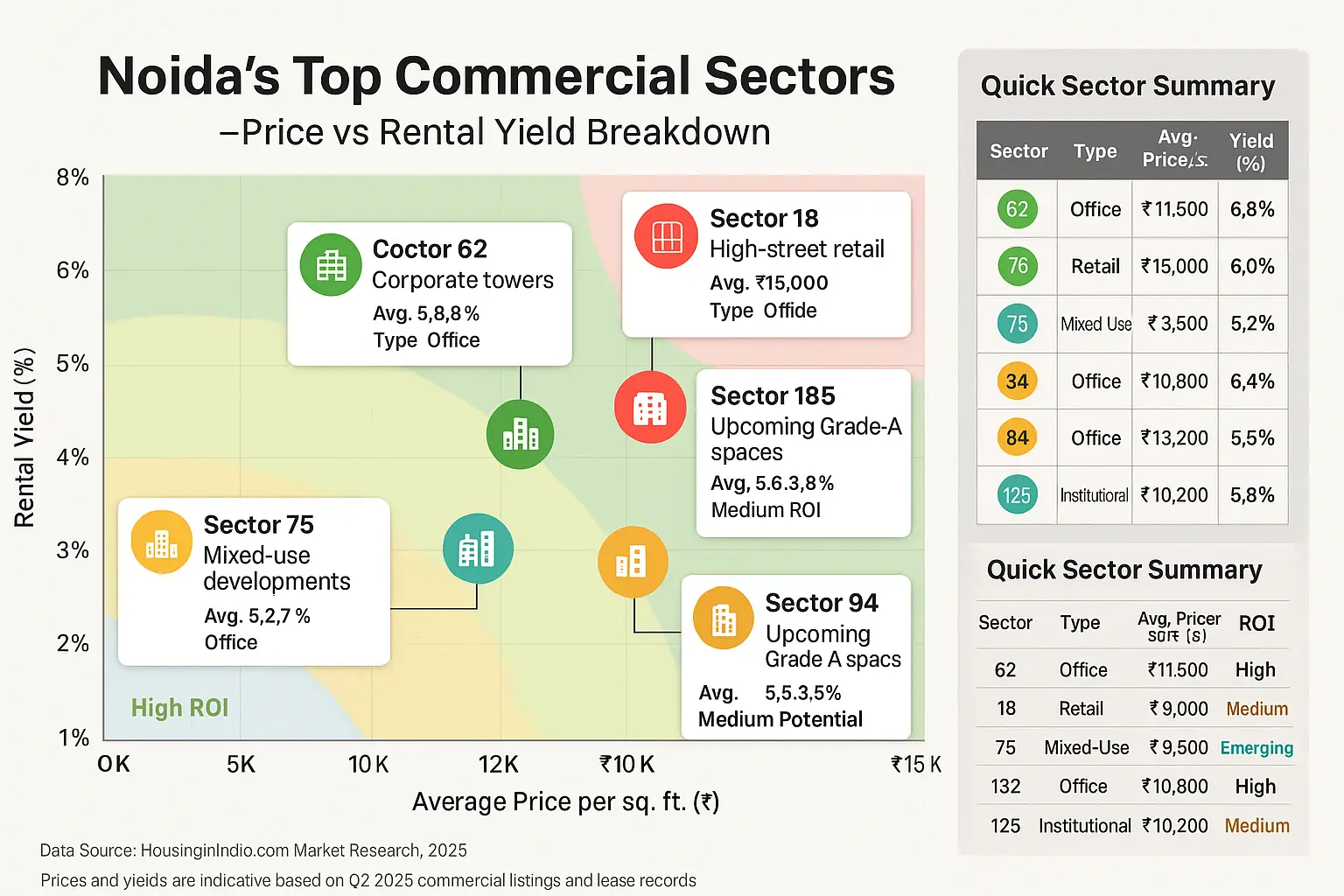

Price Trends, Rental Yield and ROI Comparison

Understanding the current market dynamics of commercial real estate in Noida is essential before making any investment decision. The return on investment (ROI) for commercial properties typically comes from two main channels: monthly rental income and capital appreciation. Each sector in Noida offers a unique combination of both, depending on location, property type, and demand.

Property Price Trends by Sector

Prices in established commercial hubs like Sector 18 and Sector 62 tend to be higher due to mature infrastructure and consistent footfall. Newer, emerging areas like Sector 104 and Sector 150 offer relatively lower entry costs with the potential for long-term appreciation as the neighborhood matures.

Here’s a snapshot of current average rates:

| Sector | Avg. Price (per sq. ft.) | Rental Yield (%) |

|---|---|---|

| Sector 18 | ₹30,000 – ₹45,000 | 6–7% |

| Sector 62 | ₹12,000 – ₹18,000 | 5.5–6.5% |

| Sector 75 | ₹8,000 – ₹12,000 | 5–6% |

| Sector 142 | ₹10,000 – ₹16,000 | 6–7% |

| Sector 104 | ₹11,000 – ₹14,000 | 5–6% |

| Sector 150 | ₹9,000 – ₹13,000 | 4.5–5.5% |

Rental Income Dynamics

Sectors with high-density residential surroundings, like Sector 75 and 76, offer stable rental income through retail shops and service-oriented businesses. In contrast, IT-driven zones like Sector 62 and 142 attract corporate leases with long-term tenures and low vacancy rates, making them ideal for investors seeking dependable rental cash flow.

Capital Appreciation Potential

Future-oriented sectors like 104 and 150 are experiencing rising interest due to planned infrastructure, luxury housing, and lifestyle appeal. These areas may not yield high rentals immediately but are expected to appreciate significantly over the next 5–10 years, especially with projects like the Film City and Expressway corridor expanding access.

Who Should Invest Where?

-

For stable monthly income: Sector 18, 62, 142

-

For long-term growth: Sector 150, 104

- For balance of both: Sector 75, 76

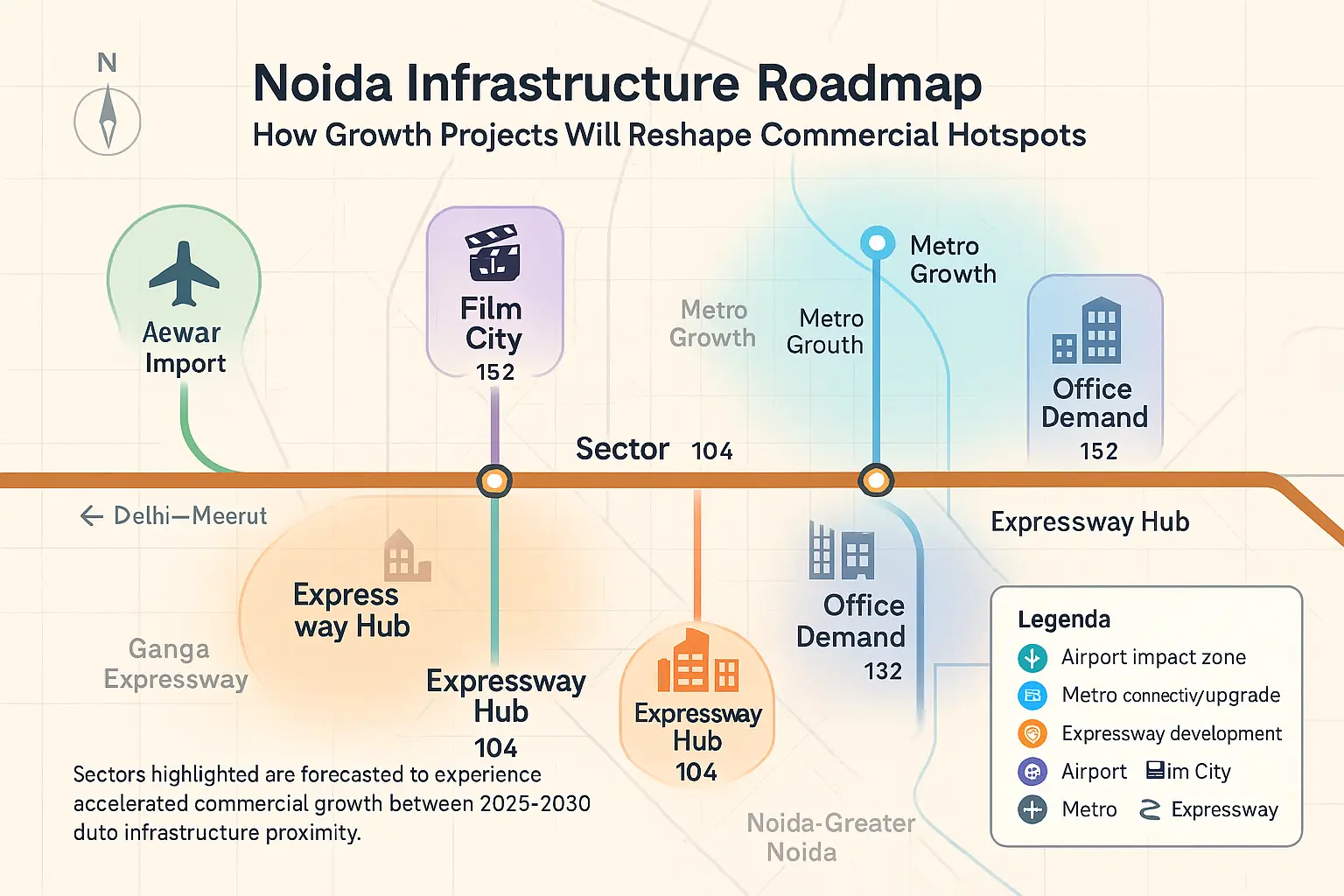

Upcoming Infrastructure Projects Boosting Commercial Potential

Noida’s commercial real estate story is not just about what exists today—it’s about what’s coming next. The city’s infrastructure pipeline is among the most ambitious in the country, with game-changing projects set to redefine real estate dynamics across several sectors. These developments are opening up new zones for commercial activity, increasing investor confidence, and driving appreciation in surrounding areas.

Jewar International Airport

Located along the Yamuna Expressway, the Noida International Airport at Jewar is one of the largest infrastructure investments in the region. Once operational, it will handle millions of passengers annually and serve as a logistics and tourism hub. Sectors near the Noida-Greater Noida Expressway, like 150 and 142, are already witnessing growing investor interest due to their proximity to the airport corridor.

Noida Film City in Sector 21

Planned as a world-class media and entertainment zone, the Noida Film City is expected to attract film studios, content creators, hospitality chains, and event spaces. This will generate significant commercial demand in nearby sectors like 94, 104, and 132—making them ideal for cafes, boutique offices, and service businesses.

Ganga Expressway & Delhi–Meerut RRTS

The Ganga Expressway and Delhi–Meerut Rapid Rail (RRTS) will enhance Noida’s connectivity with Western UP and Delhi. This will benefit commercial sectors across the eastern and southern belt of Noida, drawing more commuters and businesses into the city.

Metro Expansion (Phase 2)

With multiple metro lines expanding across Noida and Greater Noida, accessibility is improving rapidly. Stations near commercial hotspots like Sectors 75, 76, and 142 are increasing footfall, making them attractive for retail and office investments.

Data Centers & Warehousing Zones

Sectors like 143, 144, and Techzone 4 are seeing the rise of data centers, logistics parks, and warehousing facilities. These bring in ancillary commercial activity—cafes, truck stops, business hotels, repair centers, and more.

Together, these infrastructure projects are shifting the commercial investment map of Noida. Investors who identify the right sectors early stand to gain not just rental income, but significant capital appreciation in the coming years.

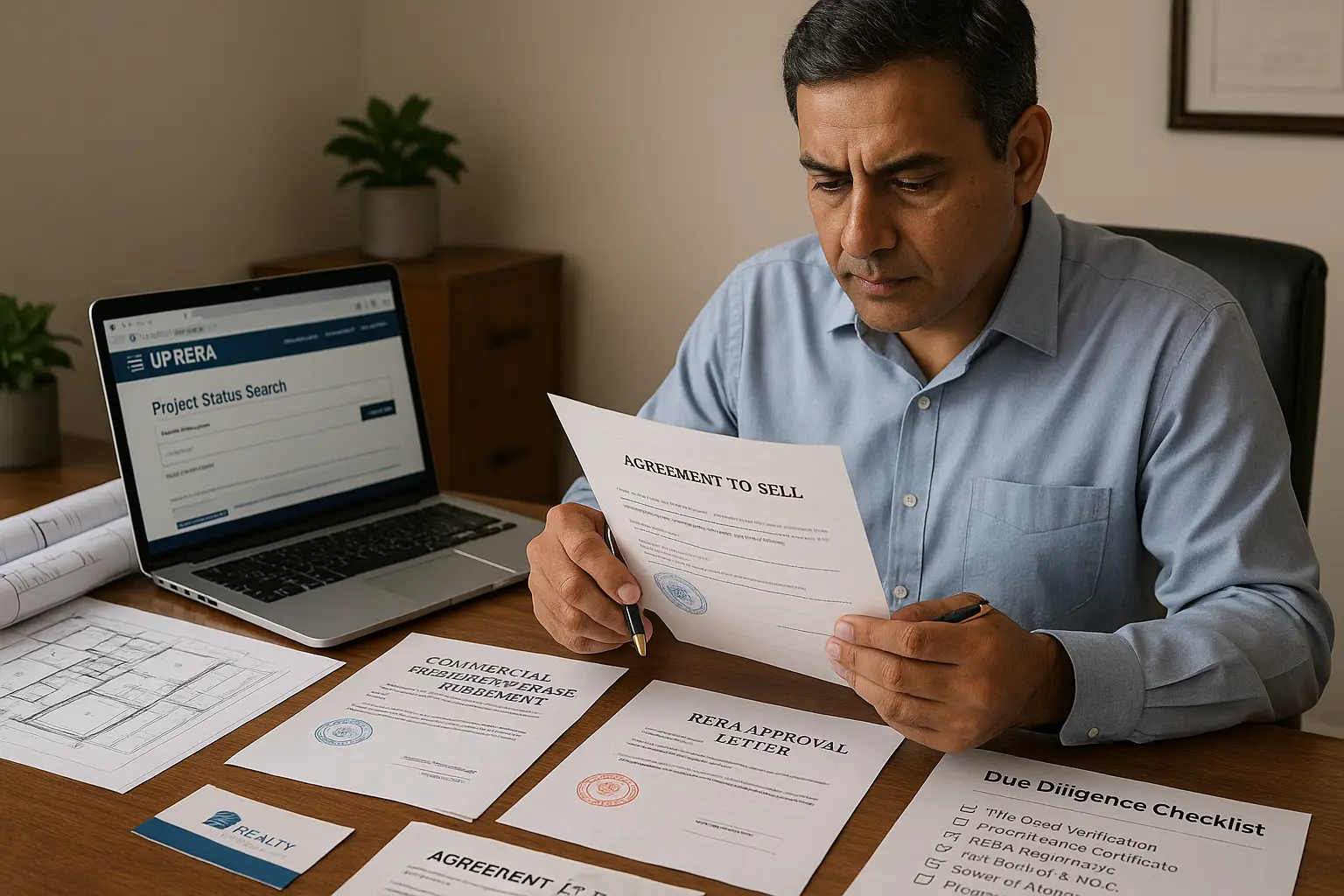

Legal and Investment Tips for Commercial Buyers in Noida

Investing in commercial property involves larger capital and greater risk than residential real estate, making it crucial to follow proper legal procedures and adopt smart investment strategies. In Noida, where multiple builders, types of commercial setups, and zoning categories coexist, due diligence becomes even more important to avoid future complications.

Check Property Zoning and Land Use Approvals

Before investing in any commercial unit—be it a retail shop, office, or showroom—verify that the project has been approved for commercial use under the Noida Authority’s zoning regulations. Some sectors allow mixed-use, while others may be designated for specific commercial or institutional functions. Investing in non-conforming properties can lead to penalties or demolition notices.

RERA Registration and Builder Verification

Always invest in properties that are registered with the Uttar Pradesh Real Estate Regulatory Authority (UP-RERA). This ensures transparency in project delivery timelines, legal clearances, and construction standards. Check the developer’s history for past delays, litigation, or construction quality issues. Trusted builders with a good delivery record offer safer returns and better resale value.

Lease vs Outright Purchase

Evaluate whether it’s better to lease or buy the property outright, based on your goals. Buying may provide capital gains and monthly rental income, while leasing offers flexibility for businesses. Investors looking for long-term ROI typically prefer outright ownership in core sectors like 62 or 142, whereas short-term ventures may opt for leasing in high-footfall areas like Sector 18.

Understand the Commercial Property Documentation

Ensure you receive and review the following documents:

-

Title deed and allotment letter

-

Approved building plan and completion certificate

-

Power of attorney (if dealing with resale or authorized agents)

-

Sale deed or lease deed (registered with sub-registrar)

-

Property tax receipts and occupancy certificate

-

Maintenance agreements, if part of a commercial complex

Plan for Additional Costs and Taxes

Factor in stamp duty (typically 6–7% in Noida for commercial units), GST (if applicable on under-construction properties), registration charges, and annual property tax. These costs impact your ROI and should be calculated before finalizing any deal.

Consult Legal and Financial Advisors

Before signing any agreement, it’s wise to consult a property lawyer and tax advisor to avoid hidden charges, ensure all clauses are investor-friendly, and verify compliance with local regulations.

Real Success Stories: Investors Who Made It Big in Noida

Real-life success stories are often the best indicators of a market’s potential. In Noida, several first-time and experienced investors have witnessed impressive returns by strategically choosing the right sectors and property types for commercial investment. These examples illustrate how timing, location, and research can convert a modest investment into a high-yielding asset.

Case Study 1: Retail Shop in Sector 75

An investor from Ghaziabad purchased a 250 sq. ft. retail unit in a high-street market of Sector 75 in 2018 for around ₹30 lakhs. The shop, surrounded by over 5,000 residential apartments, attracted consistent foot traffic. Within five years, rental income rose from ₹18,000/month to ₹32,000/month. The property is now valued at over ₹55 lakhs—an appreciation of nearly 80%, excluding rental gains.

Case Study 2: Office Space in Sector 62

A Delhi-based startup invested in a 1,200 sq. ft. office space in Sector 62 in 2016, priced at ₹80 lakhs. The space, located near the metro and surrounded by IT firms, was leased to an MNC for ₹75,000/month by 2021. When the company exited in 2024, the property was sold for ₹1.4 crores, giving the owner over 12% annualized returns including rent.

Case Study 3: Pre-Launch Purchase in Sector 142

A seasoned investor bought a commercial unit during the pre-launch phase of a mixed-use project in Sector 142 in 2020. With the opening of the expressway-facing development and rise in office demand post-COVID, rental yields exceeded 8% by 2024. The value appreciated by 50% in under four years, making it one of the most rewarding early-entry investments.

These stories prove that Noida’s commercial real estate isn’t just about capital—it’s about strategic choices. Whether it’s a retail shop in a residential hub or an office in an IT zone, aligning your investment with sector-specific growth can yield long-term rewards.

Is Commercial Real Estate in Noida Worth It?

Absolutely. Noida stands out as one of the most promising commercial real estate destinations in North India. It offers a rare combination of affordability, modern infrastructure, and future-forward growth. From high-rental office spaces near IT corridors to retail outlets in densely populated residential sectors, the city caters to a diverse range of commercial investors.

Its strategic connectivity to Delhi, growing metro network, and the emergence of major projects like Jewar Airport and the Noida Film City only strengthen its appeal. Additionally, with an increasing number of startups, corporates, and entrepreneurs looking for office and retail space in the region, demand is set to rise steadily in the coming years.

More importantly, commercial real estate in Noida is not just about immediate returns. It’s about owning an appreciating asset in a city that’s evolving into a business powerhouse. Whether you’re a first-time investor or expanding your portfolio, Noida offers well-balanced opportunities across price points, sectors, and commercial types.

With the right location, sound legal advice, and a forward-looking strategy, your commercial investment in Noida can deliver stable income, long-term gains, and lasting value.

Quick FAQ for Commercial Property Investors in Noida

Which sector in Noida offers the best ROI for commercial investment?

Sectors like 62 and 142 offer strong rental income due to high corporate presence, while sectors like 104 and 150 show high potential for capital appreciation due to upcoming infrastructure.

Can I buy commercial property in Noida through a home loan?

Yes, banks and NBFCs offer loans for commercial property, though the terms differ from home loans. Interest rates are slightly higher, and banks may require a larger down payment.

Is RERA registration necessary for commercial properties?

Yes, it is highly recommended to invest in RERA-registered commercial projects for legal security and transparency in possession timelines and project approvals.

What is the stamp duty for commercial properties in Noida?

Stamp duty is typically around 6%–7% of the property value for commercial spaces in Uttar Pradesh, along with registration fees and applicable GST on under-construction units.

What are the risks involved in commercial real estate?

Risks include longer vacancy periods, location saturation, maintenance costs, and legal issues if due diligence is not done. However, proper planning and project verification can minimize these risks.